USAA, or United Services Automobile Association, is a well-known insurance company that primarily serves military members, veterans, and their families. Known for its excellent customer service, strong financial stability, and competitive rates, USAA has gained a loyal following.

Understanding USAA Auto Insurance

USAA offers a variety of auto insurance products designed to meet the unique needs of its members. These products include:

- Liability Insurance: Covers damages to other people’s property or injuries to others in an accident caused by you.

- Collision Insurance: Covers damage to your vehicle in a collision, regardless of fault.

- Comprehensive Insurance: Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Additional Coverage Options: USAA offers a range of additional coverage options, including rental car reimbursement, roadside assistance, and emergency roadside dispatch.

Key Features of USAA Auto Insurance

- Competitive Rates: USAA often offers competitive rates, especially for members with good driving records.

- Excellent Customer Service: USAA is known for its exceptional customer service, with dedicated agents available to assist members with any questions or concerns.

- Strong Financial Stability: USAA is a financially stable company with a strong track record of paying claims.

- Military Discounts: As a military-focused company, USAA offers special discounts to eligible members.

- Digital Tools: USAA provides convenient digital tools, such as mobile apps and online portals, to manage your policy and file claims.

How to Qualify for USAA Auto Insurance

To qualify for USAA auto insurance, you must be a current or former member of the U.S. military, a spouse, or a dependent. This includes active-duty military personnel, veterans, and their families.

How to Get a Quote from USAA

You can get a quote from USAA through the following methods:

- Online: Visit the USAA website and use their online quoting tool.

- Phone: Call USAA’s customer service number to speak with an agent.

- Local USAA Office: Visit a local USAA office to get a personalized quote.

Tips for Saving Money on USAA Auto Insurance

- Maintain a Good Driving Record: A clean driving record can lead to significant discounts.

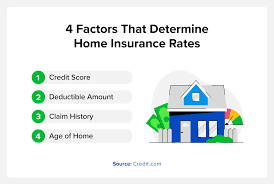

- Bundle Policies: Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can save you money.

- Take Advantage of Discounts: USAA offers various discounts, including military discounts, good student discounts, and safe driver discounts.

- Increase Your Deductible: A higher deductible can lower your monthly premium.

- Shop Around: While USAA is a great option, it’s always a good idea to compare quotes from other insurers to ensure you’re getting the best deal.

Conclusion

USAA is a highly-regarded insurance company, especially for military members and their families. With its competitive rates, excellent customer service, and strong financial stability, it’s a top choice for many. However, it’s important to compare quotes and consider your individual needs to determine if USAA is the best fit for you.

FAQs: USAA Auto Insurance

Here are some frequently asked questions about USAA Auto Insurance:

General Questions

- What is USAA? USAA is a financial services company that primarily serves military members, veterans, and their families. It offers a wide range of financial products, including auto insurance.

- Is USAA a good insurance company? Yes, USAA is highly regarded for its excellent customer service, strong financial stability, and competitive rates, especially for military members and their families.

USAA Auto Insurance

- What types of auto insurance does USAA offer? USAA offers a variety of auto insurance coverage, including liability, collision, comprehensive, and additional coverage options like roadside assistance and rental car reimbursement.

- How can I get a quote from USAA? To get a quote from USAA, you must be a member. You can get a quote online, by phone, or by visiting a local USAA office.

- What factors affect my USAA auto insurance rates? Your USAA auto insurance rates can be affected by various factors, including your driving record, age, location, type of vehicle, and coverage limits.

Membership and Eligibility

- Who is eligible for USAA membership? To be eligible for USAA membership, you must be a current or former member of the U.S. military, a spouse, or a dependent.

- Can I transfer my USAA membership to a family member? Yes, you can transfer your USAA membership to eligible family members.

Additional Tips

- How can I improve my USAA auto insurance rate? You can improve your rate by maintaining a good driving record, taking defensive driving courses, and bundling policies.

- What is USAA’s claims process like? USAA has a streamlined claims process. You can file a claim online, by phone, or in person at a local USAA office.

By understanding these FAQs, you can make an informed decision about whether USAA auto insurance is the right choice for you.

Leave a Reply