Direct Auto Insurance is a non-standard auto insurance company that specializes in providing affordable coverage to drivers with less-than-perfect driving records. They cater to individuals who may have difficulty finding insurance elsewhere, often due to factors like accidents, traffic violations, or a lack of driving history.

Understanding Non-Standard Auto Insurance

Non-standard auto insurance is designed for drivers who don’t qualify for standard auto insurance policies. This often includes individuals with:

- Poor driving records: Multiple accidents, traffic violations, or DUIs

- Limited driving history: New drivers or those with gaps in their driving history

- Low credit scores

- Multiple policy cancellations

These factors can make it challenging to find affordable insurance with traditional insurers. Non-standard insurers like Direct Auto specialize in insuring these high-risk drivers.

Key Features of Direct Auto Insurance

- Affordability: Direct Auto offers competitive rates for drivers who may have difficulty finding affordable insurance elsewhere.

- Flexible Payment Plans: They provide flexible payment options to accommodate various budgets.

- Easy Online Access: You can manage your policy, pay bills, and file claims online.

- 24/7 Customer Support: Direct Auto offers round-the-clock customer support to assist with any questions or concerns.

- Roadside Assistance: In many cases, roadside assistance is available as an add-on to your policy.

How to Get a Quote with Direct Auto Insurance

You can get a quote from Direct Auto Insurance in a few simple ways:

- Online: Visit the Direct Auto website and use their online quoting tool to get an instant quote.

- Phone: Call Direct Auto’s customer service number to speak with an agent and get a quote.

- In-Person: Visit a local Direct Auto office to get a quote in person.

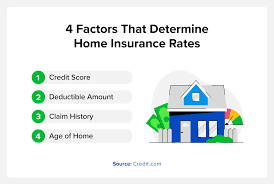

Factors Affecting Your Direct Auto Insurance Rates

Several factors can influence your Direct Auto Insurance rates, including:

- Driving Record: As mentioned, a poor driving record can significantly impact your rates.

- Vehicle Type: The type of vehicle you drive can affect your premium.

- Coverage Limits: The amount of coverage you choose can impact your rate.

- Deductible: A higher deductible can lower your monthly premium.

- Location: Where you live can affect your insurance rates due to factors like crime rates and accident frequency.

Tips for Finding Affordable Non-Standard Auto Insurance

- Shop Around: Compare quotes from multiple non-standard insurers to find the best deal.

- Improve Your Credit Score: A good credit score can help you qualify for better rates.

- Take Defensive Driving Courses: Completing a defensive driving course can reduce your insurance rates.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your rates low.

- Consider a High Deductible: A higher deductible can lower your monthly premium.

- Bundle Policies: If you have multiple vehicles or other insurance needs, bundling policies with Direct Auto can potentially save you money.

While non-standard auto insurance may be more expensive than standard insurance, it’s essential for high-risk drivers to have adequate coverage. By understanding the factors that affect your rates and shopping around for the best deal, you can find affordable insurance that meets your needs.

FAQs

- Is Direct Auto Insurance a reliable company? Direct Auto Insurance is a reputable company that has been providing insurance to high-risk drivers for many years.

- What is the process of filing a claim with Direct Auto Insurance? You can file a claim with Direct Auto Insurance by contacting their customer service number or visiting their website. They have a streamlined claims process to help you get back on the road quickly.

- Does Direct Auto Insurance offer roadside assistance? Yes, Direct Auto Insurance offers roadside assistance as an optional add-on to your auto insurance policy.

- Can I improve my Direct Auto Insurance rates over time? Yes, by maintaining a clean driving record and making timely payments, you may be able to improve your rates over time.

- What is the difference between standard and non-standard auto insurance? Standard auto insurance is for drivers with good driving records, while non-standard auto insurance is for drivers with less-than-perfect driving records.

By understanding these FAQs and tips, you can make informed decisions about your non-standard auto insurance needs.

FAQs: Direct Auto Insurance

Here are some frequently asked questions about Direct Auto Insurance:

General Questions

- What is Direct Auto Insurance? Direct Auto Insurance is a non-standard auto insurance company that specializes in providing affordable coverage to high-risk drivers.

- Is Direct Auto Insurance reliable? Yes, Direct Auto Insurance is a reputable company that has been providing insurance to high-risk drivers for many years.

- How can I get a quote from Direct Auto Insurance? You can get a quote from Direct Auto Insurance by visiting their website, calling their customer service number, or visiting a local Direct Auto office.

Non-Standard Auto Insurance

- What is non-standard auto insurance? Non-standard auto insurance is designed for drivers who don’t qualify for standard auto insurance policies due to factors like poor driving records or limited driving history.

- Why is non-standard auto insurance more expensive? Non-standard auto insurance is generally more expensive because it covers higher-risk drivers.

Direct Auto Insurance Policies

- What types of coverage does Direct Auto offer? Direct Auto offers various coverage options, including liability, collision, and comprehensive.

- Does Direct Auto offer roadside assistance? Yes, Direct Auto offers roadside assistance as an optional add-on to your auto insurance policy.

- How can I improve my Direct Auto Insurance rates? You can improve your rates by maintaining a clean driving record, taking defensive driving courses, and bundling policies.

By understanding these FAQs, you can make informed decisions about your non-standard auto insurance needs.

Leave a Reply